US negotiators are nearing an agreement on their debt.

In the midst of an AI stock frenzy, technology shares are still in focus.

On indications that US negotiators are getting closer to reaching a debt deal, European markets increased and Treasury yields moved down a bit.

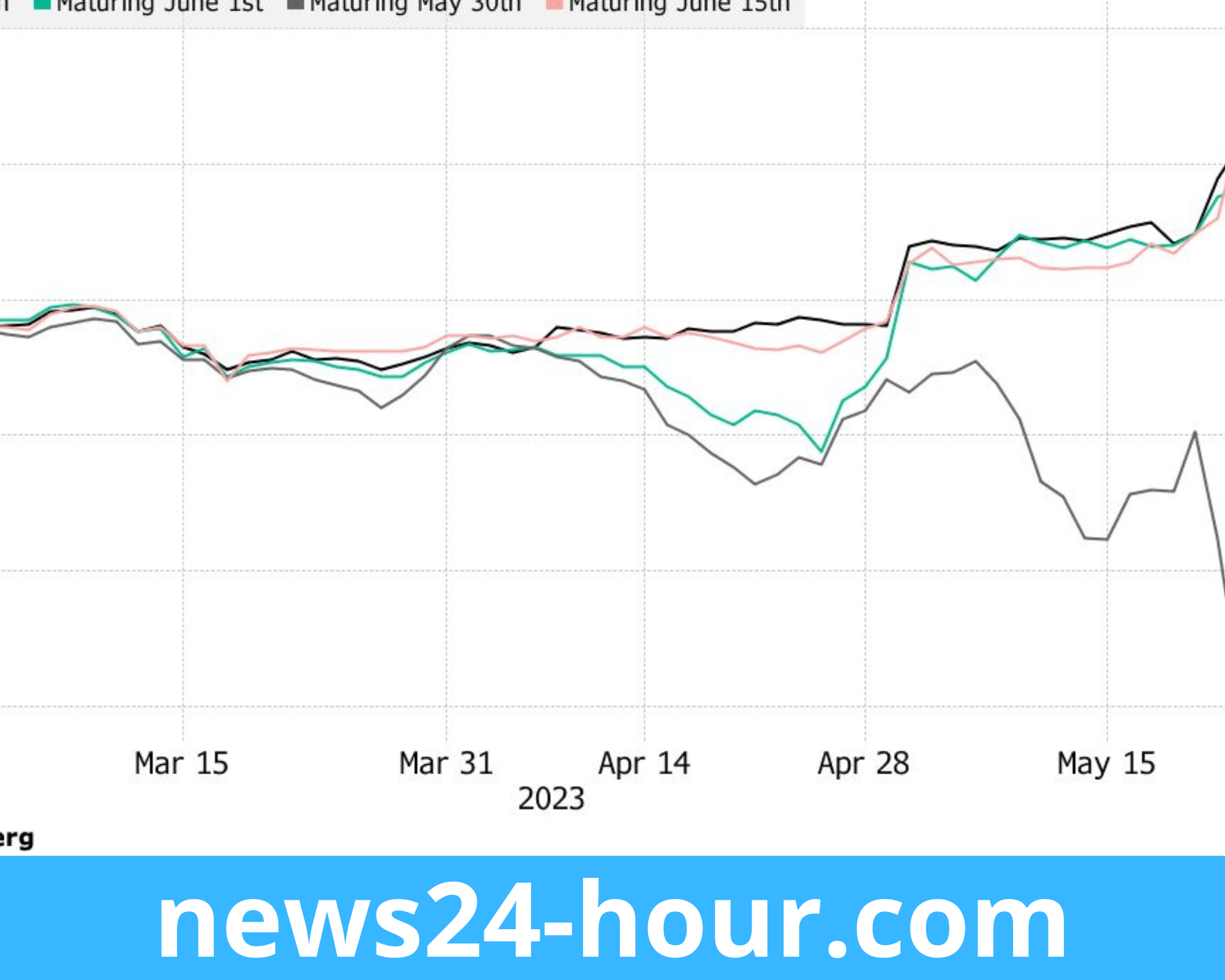

After rising for ten consecutive days, the yield on two-year notes was hovering at 4.52%, the highest level since March. Investor demand for the US debt that is most likely to default if Congress and the White House are unable to reach an agreement has decreased, but concerns are still very high.

As commodities prices recovered, mining companies helped push European averages higher. ASML Holding NV increased 1.7%, and BE Semiconductor increased 2%, continuing yesterday’s frenzy for businesses involved with artificial intelligence. US futures remained stable.

Stuart Cole, head macro economist at brokerage at Equiti Capital UK Ltd., stated that the market “remains very much focused on the US debt ceiling talks, even though we have been in this situation a number of times in the recent past.” “The recovery seen yesterday following the better sales forecast from Nvidia suggests that concerns over the debt talks are quickly forgotten as soon as an opportunity arises.”

When Marvell Technology Inc. predicted that income from the technology will at least double from a year ago in 2024, the AI surge continued after hours in the US. Asia saw substantial gains from South Korea’s SK Hynix Inc., Japan’s Screen Holdings Co., Japan’s Taiwan Semiconductor Manufacturing Co., and South Korea’s SK Hynix Inc.

Benchmark indices increased in Australia, South Korea, India, and Japan, while mainland Chinese indices reversed earlier dips. According to the most recent Bloomberg survey of experts, China’s central bank will probably reduce the reserve requirement ratio for major banks earlier than anticipated.

Due to a holiday, the market in Hong Kong was closed on Friday.

The yen marginally grew in strength against the dollar while staying close to the 140 level, while a measure of the dollar’s strength declined. As speculation grows that the Federal Reserve will raise interest rates during the next two policy meetings while its counterpart in Tokyo maintains an ultra-loose monetary policy, the value of the Japanese yen has fallen.

More information can be found at US on “Borrowed Time” as Debt Cap Drives Cash Below $50 Billion.

Oil prices were stable on other markets despite Thursday’s more than 3% decline as Russia hinted OPEC+ was unlikely to alter output levels at its next meeting.