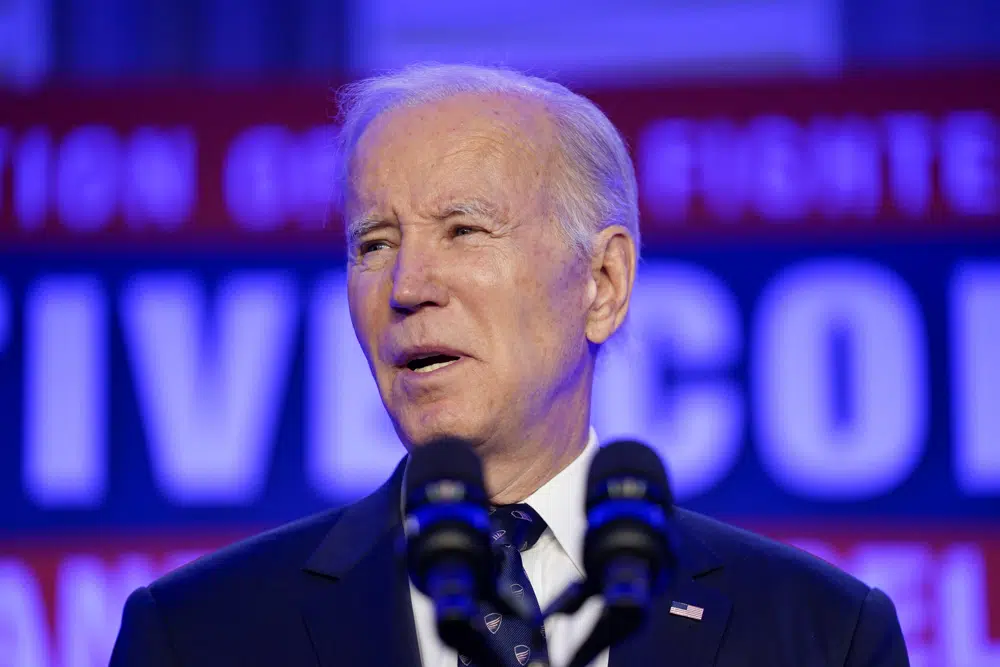

Washington, D.C. On Tuesday, President Joe Biden proposed new taxes on the wealthy to help pay for Medicare. He claimed the proposal would help to extend the insurance program’s solvency by 25 years and offer some security to millions of senior citizens.

Biden explicitly states in his proposal that higher taxes on the wealthy are necessary. In essence, he would be asking those who have done the best economically to subsidize the rest of the population by linking these new taxes directly to the well-liked health insurance scheme for those over 65.

Including wages and capital gains, Biden wants to raise the Medicare tax rate from 3.8% to 5% on incomes over $400,000 annually. The White House did not include precise cost-saving estimates with the proposal, but earlier projections made in February by the Tax Policy Center indicated that the action would likely raise tax revenues by more than $117 billion over ten years.