Skip to content

As inflation declined more slowly than anticipated in April, food costs in the UK continued to rise at the quickest rate in over 45 years

While supermarket price growth eased slightly in the year to April, it still approached record highs at 19.1%.

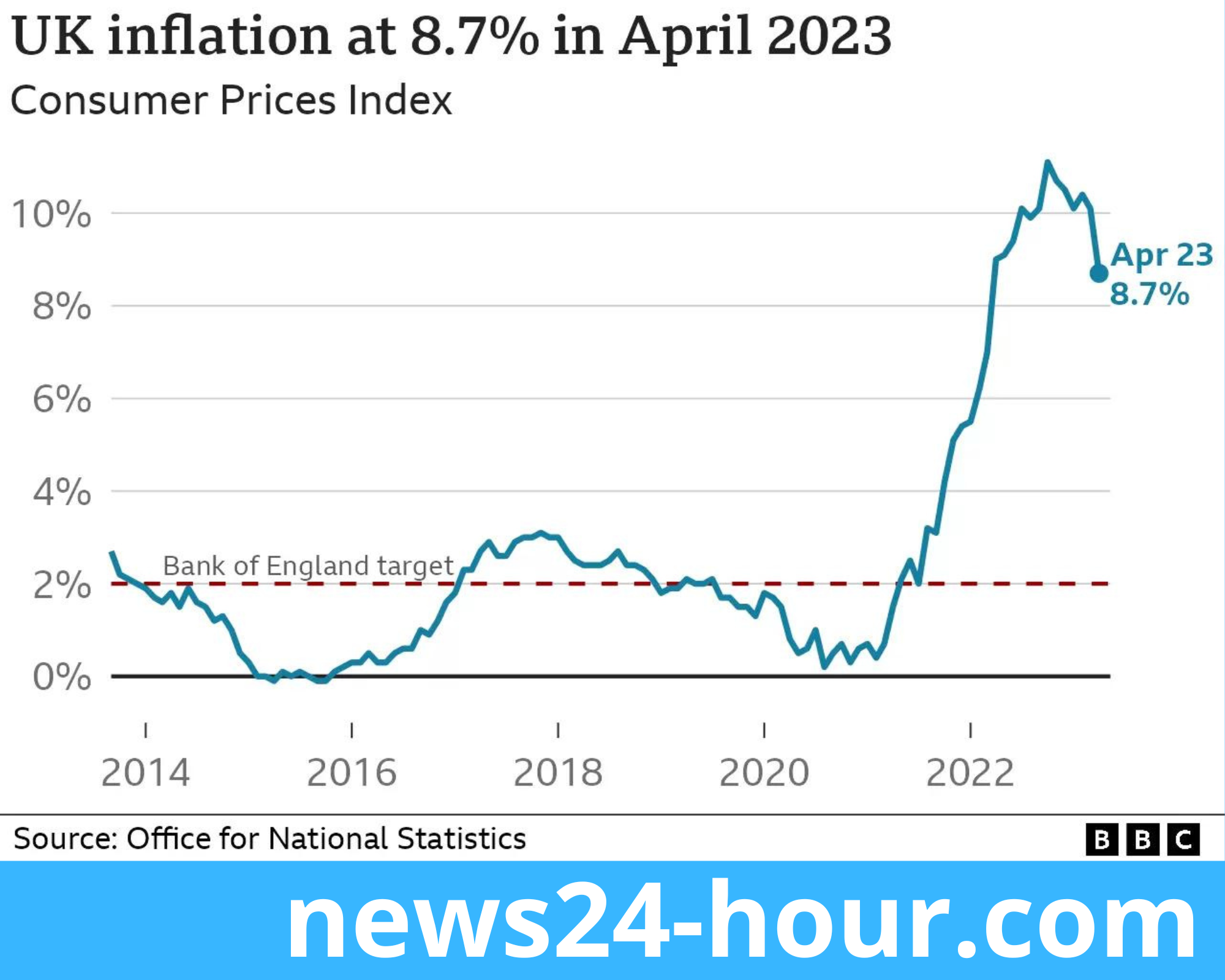

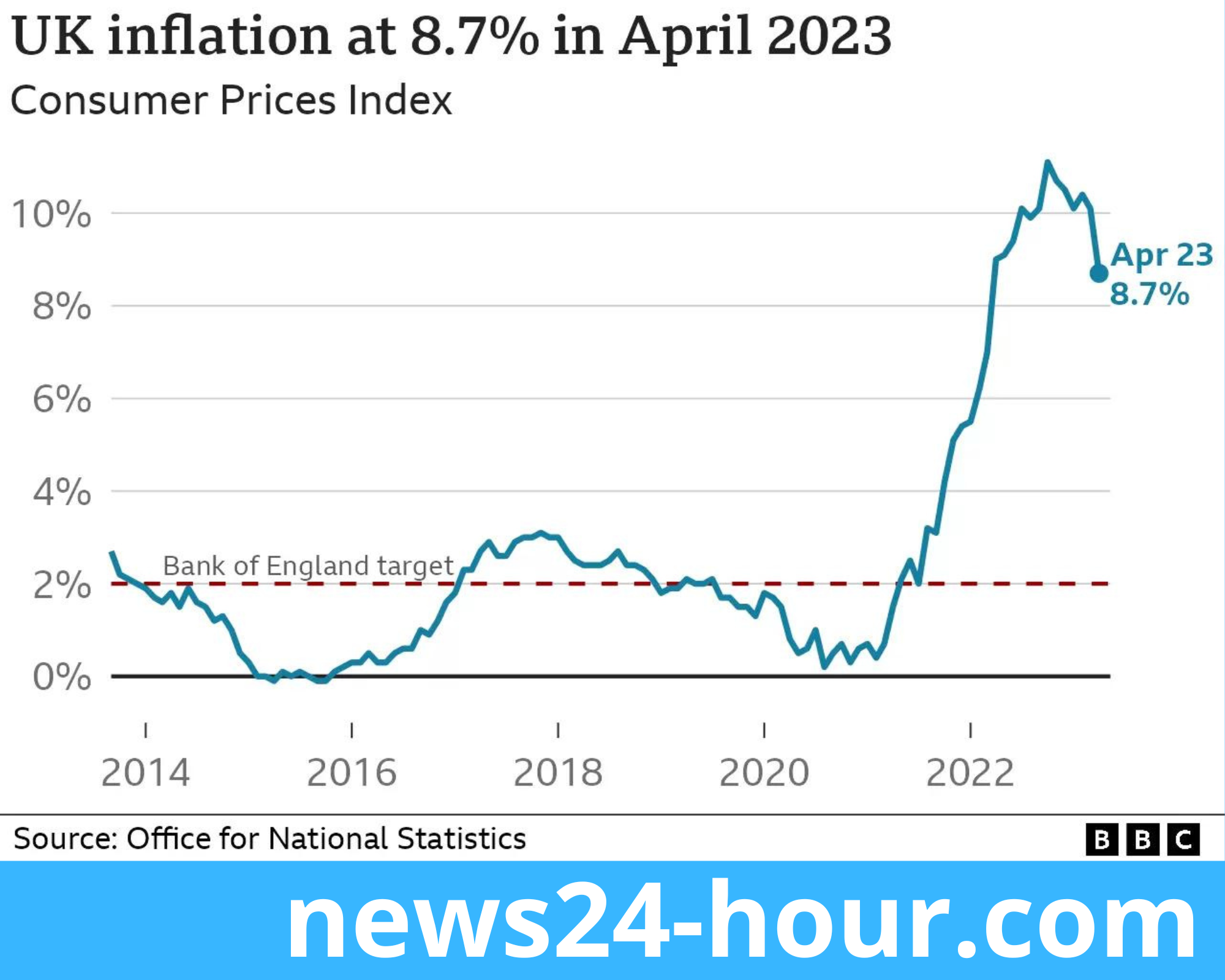

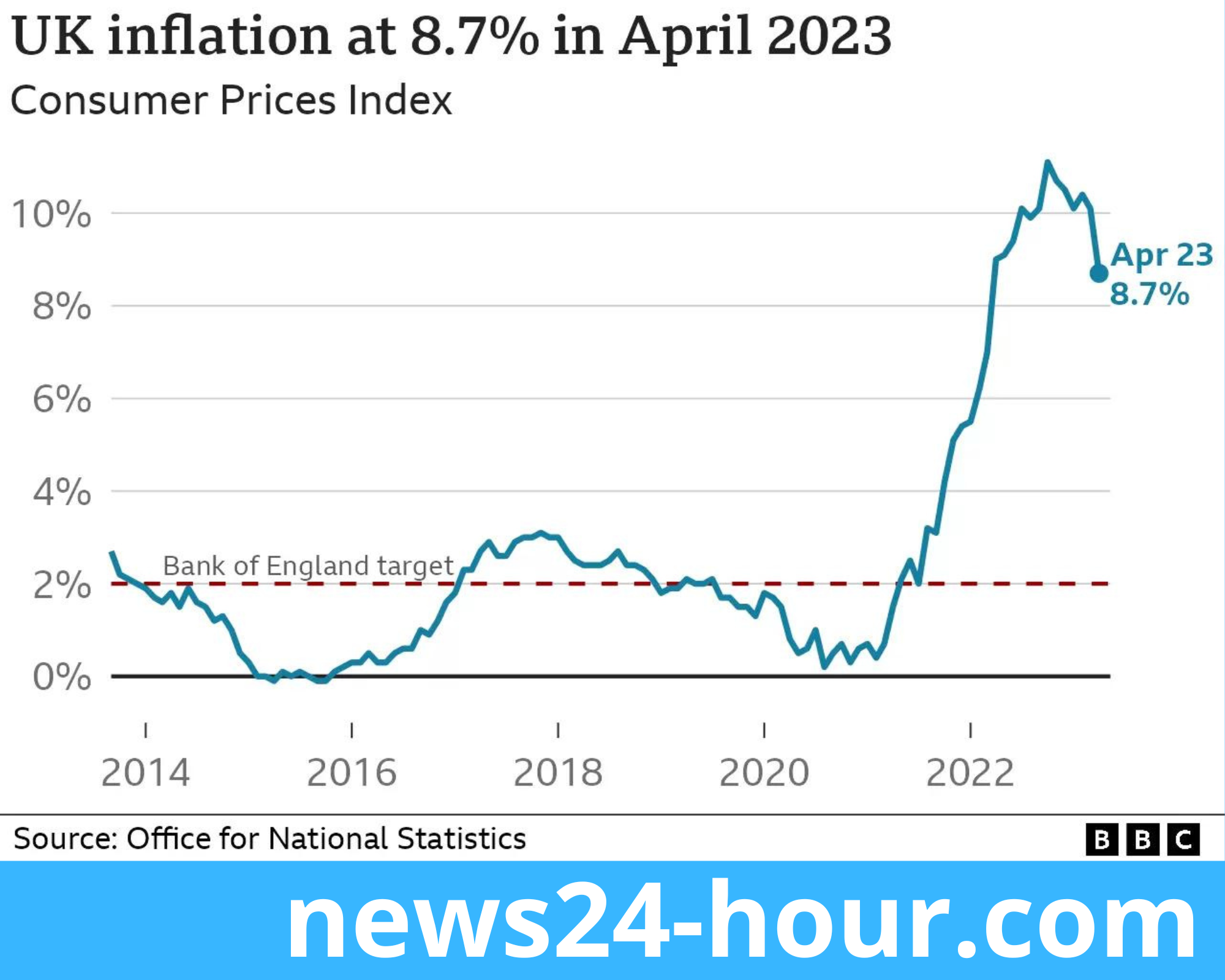

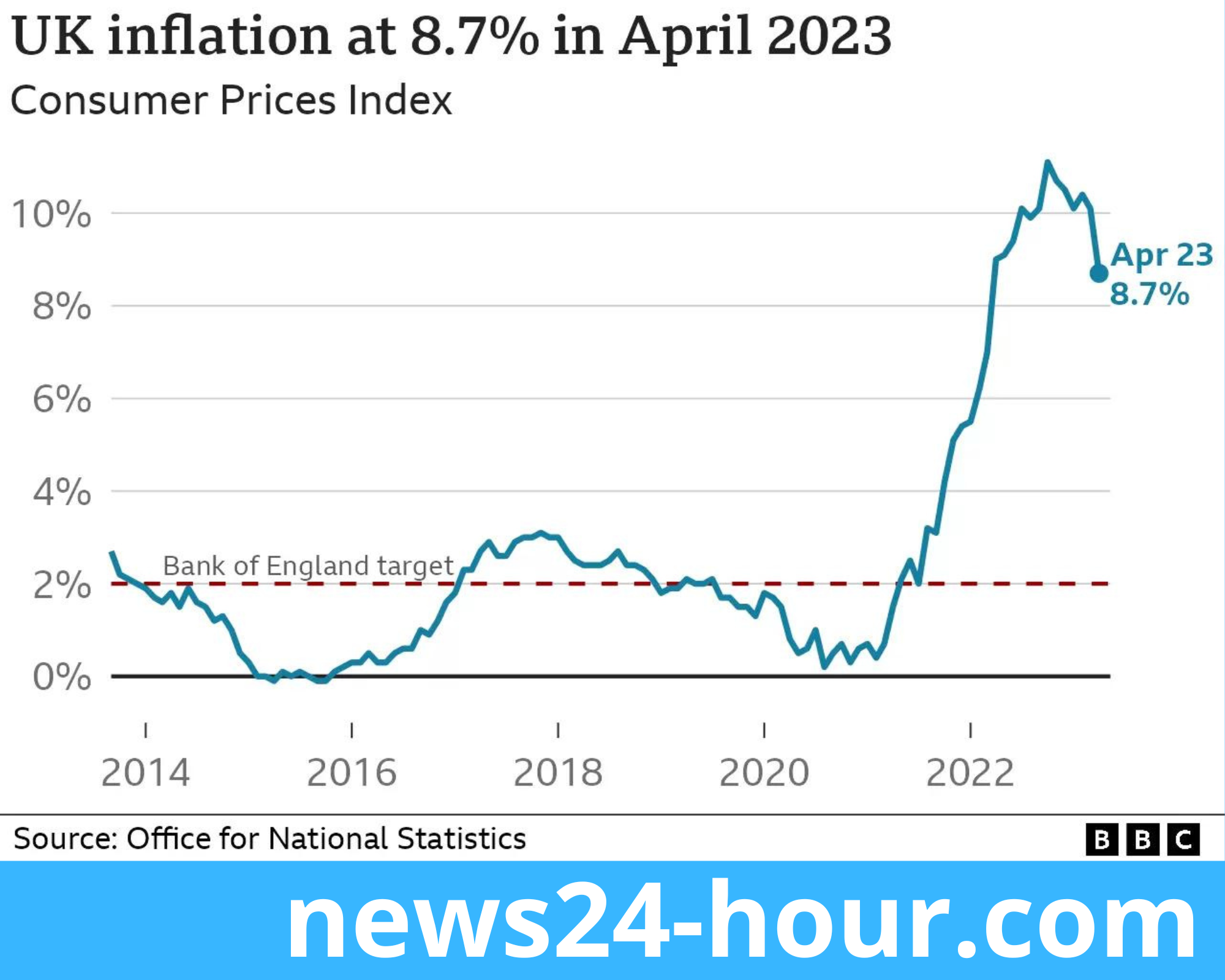

Inflation in the UK as a whole dropped significantly at the same time, reaching single digits for the first time since last August.

The chancellor stated that food costs were “worryingly high” despite the fact that they did not drop as much as anticipated.

In the year ending in April, prices increased by 8.7%, according to the Office for National Statistics (ONS).

This is lower than the 10.1% in March but higher than the 8.2% number that experts had commonly predicted.

The decrease can be attributed to the fact that energy price increases are moderating from the rapid increases experienced a year ago, immediately following Russia’s invasion of Ukraine and the imposition of sanctions on it.

However, this merely indicates that prices are growing more slowly, not that they are decreasing.

Although the substantial decline in inflation’s headline rate was “good news,” Chancellor Jeremy Hunt admitted: “There are elements below those data which demonstrate that this war is far from done.

“We still have a ways to go.”

– Why are prices rising even when inflation is declining?

– How does inflation work?

According to the ONS, several vegetables, including potatoes, are now more costly than they were a year ago.

The price of commodities including bread, cereal, fish, milk, and eggs had decreased, the report claimed, despite the fact that food price inflation was still quite near its previous peak.

“If you look at what prices businesses are facing and how much they’re paying for domestic food materials, that has come down from over 15% annually last month to under 10% this month,” said Grant Fitzner, ONS’s senior economist.

Prices that businesses pay for imported commodities have also “considerably” decreased.

He said, “Of course, those aren’t reflected on supermarket shelves yet.”

Retailers assert that because they often sign long-term contracts with food manufacturers, declining wholesale prices take longer to make their way to store shelves.

On Tuesday, Mr. Hunt met with food producers to talk about the price of food and explore options for relieving family stress.

This comes after the Competition and Markets Authority started looking into how much food and gasoline cost at UK retailers.

Even while the headline inflation rate decreased, the so-called core inflation rate—which excludes costs for food and energy—rose to a 31-year high of 6.8% in April.

According to Mr. Hunt, the government would “be relentless in sticking to the plan to bring down inflation” since it is placing “enormous pressure” on consumers and industrial dissatisfaction.

Rachel Reeves, Labour’s shadow chancellor, asserted that people would be concerned about the continued high cost of food and other necessities.

“They will be asking why this Tory government still refuses to adequately address this cost of living crisis, and why they won’t introduce a proper windfall tax on the enormous profits of oil and gas giants,” says the author.

The Bank of England’s target inflation rate of 2% was still four times higher in April.

In order to slow down price hikes, it has increased interest rates 12 times since December 2021.This should help savers, but it has increased borrowing prices for millions of those who have mortgages.

When the Bank of England meets on June 22, Samuel Tombs of Pantheon Macroeconomics believes that another interest rate increase is “now is firmly on the table,” perhaps raising borrowing rates from 4.5% to 4.75%.

To contact us via gmail :